This website is operated by GoHealth, LLC., a licensed health insurance company.

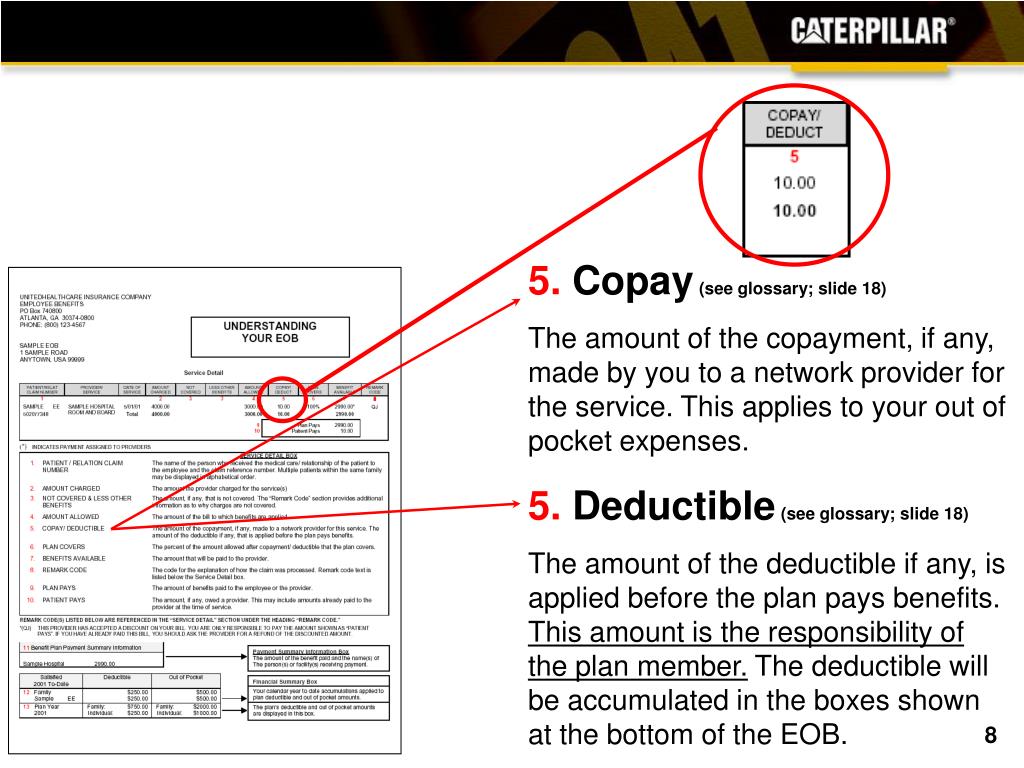

Benefits may vary by carrier and location. Not all plans offer all of these benefits. GoHealth helps Medicare beneficiaries enroll in Medicare Advantage plans. Your coinsurance would be $180 before your deductible is met, and $36 after your deductible is met.If you have a $20 copay and 80/20 coinsurance, for a doctor visit that costs $180: This means, after your deductible, you pay 20% and insurance pays 80%. After you reach $1,000, you may only be responsible for 20% of your cost if your plan has an 80/20 coinsurance. For example, if your deductible is $1,000, you pay 100% of costs until you reach $1,000. That means if your copay for a primary care visit is $20, you pay $20 instead of the $180.Ĭoinsurance is a cost percentage split between you and your insurance company after you meet your deductible. For example, a primary care visit may cost $180, but you only pay your copay amount for the visit. Here’s an example of how they work with your plan:Ī copay is a flat rate you will pay for a visit to the doctor. Coinsurance usually begins after you have met your deductible, whereas copays generally must be paid at the time you receive care.

For example, your insurance plan may cover 80% of the cost, while you’re responsible for the remaining 20%. Coinsurance is a percentage of a total medical bill split between you and your insurer. Copays and coinsurance are two different costs shared with your insurance company.

0 kommentar(er)

0 kommentar(er)